Getting The Life Insurance Agent In Jefferson Ga To Work

Table of ContentsAn Unbiased View of Insurance Agency In Jefferson GaAll About Life Insurance Agent In Jefferson GaWhat Does Insurance Agency In Jefferson Ga Mean?The Ultimate Guide To Insurance Agency In Jefferson Ga

Learn more about exactly how the State of Minnesota sustains energetic solution participants, veterans, and their families.

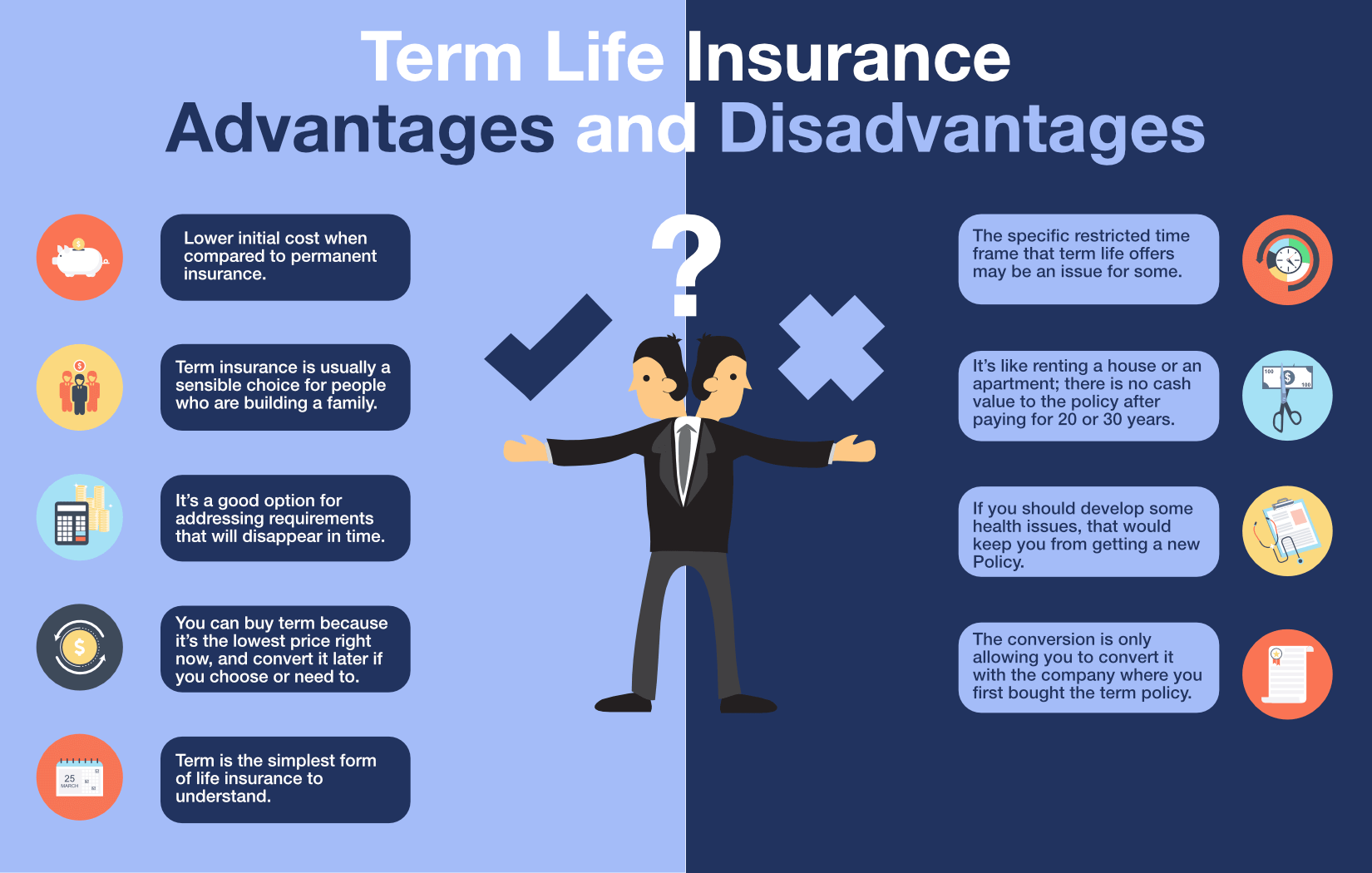

Term insurance coverage gives security for a specified duration of time. This period could be as brief as one year or supply coverage for a details variety of years such as 5, 10, 20 years or to a defined age such as 80 or sometimes up to the earliest age in the life insurance policy mortality tables.

If you die throughout the term period, the business will pay the face amount of the plan to your recipient. As a guideline, term plans provide a death advantage with no financial savings element or money worth.

Facts About Home Insurance Agent In Jefferson Ga Revealed

The costs you pay for term insurance policy are reduced at the earlier ages as compared to the costs you pay for long-term insurance coverage, yet term rates rise as you get older. Term plans might be "convertible" to an irreversible plan of insurance. The insurance coverage can be "level" giving the exact same advantage up until the policy runs out or you can have "reducing" coverage during the term period with the costs remaining the same.

Presently term insurance rates are extremely competitive and among the most affordable historically seasoned. It ought to be kept in mind that it is an extensively held idea that term insurance policy is the least expensive pure life insurance policy protection offered. https://share.pblc.it/p/D2sBYy._fT.S382301. One requires to examine the policy terms thoroughly to make a decision which term life choices appropriate to satisfy your specific scenarios

You have to exercise this alternative throughout the conversion period. The length of the conversion duration will certainly vary depending on the kind of term policy purchased. If you convert within the recommended period, you are not needed to give any details regarding your wellness. The premium price you pay on conversion is normally based upon your "existing achieved age", which is your age on the conversion date.

Under a degree term policy Visit Your URL the face amount of the plan stays the very same for the whole duration. With decreasing term the face quantity lowers over the period - Insurance Agency in Jefferson GA. The costs remains the same each year. Often such plans are sold as mortgage security with the amount of insurance coverage reducing as the balance of the home mortgage lowers.

How Insurance Agent In Jefferson Ga can Save You Time, Stress, and Money.

Traditionally, insurance providers have not deserved to alter premiums after the plan is offered. Because such policies might continue for years, insurers should make use of traditional mortality, passion and cost price quotes in the premium computation. Flexible costs insurance, however, enables insurers to use insurance policy at lower "present" costs based upon much less conventional presumptions with the right to change these costs in the future.

Occasionally, there is no correlation in between the dimension of the money value and the premiums paid. It is the cash worth of the plan that can be accessed while the insurance policy holder is active. The Commissioners 1980 Criterion Ordinary Death Table (CSO) is the existing table made use of in determining minimum nonforfeiture values and policy gets for common life insurance policy plans.

The plan's essential elements include the costs payable every year, the survivor benefit payable to the recipient and the cash money abandonment worth the insurance policy holder would certainly get if the policy is surrendered before fatality. You may make a funding against the cash worth of the plan at a specified interest rate or a variable price of interest but such outstanding finances, if not repaid, will certainly minimize the death advantage.

Home Insurance Agent In Jefferson Ga Fundamentals Explained

If these quotes change in later years, the business will change the costs appropriately yet never above the maximum guaranteed premium stated in the policy. An economatic entire life policy gives for a basic quantity of participating entire life insurance policy with an added supplemental insurance coverage offered via using rewards.

Eventually, the reward additions need to equate to the initial amount of additional coverage. Nonetheless, since dividends may not be adequate to acquire enough paid up enhancements at a future day, it is feasible that at some future time there could be a considerable reduction in the quantity of supplemental insurance coverage.

Because the premiums are paid over a much shorter span of time, the premium repayments will certainly be greater than under the whole life plan. Solitary costs whole life is minimal payment life where one huge superior payment is made. The plan is totally paid up and no further costs are required.